“I make a motion we lower the tax burden on our citizens with the Voter Approval Rate of .432511 per $100 assessed valuation,” said Fairfield Councilmember Arland Thill during a Special Called meeting on Thursday, August 4, 2022.

The motion was unanimously approved, with Councilman Stephen Daniel absent from the proceedings.

The proposed tax rate is 6% lower than the previous year’s tax rate.

However, with this year’s rise in property values in Freestone County, the proposed tax rate is expected to generate a total of $72,194 more in revenue. (article published in the 081022 print edition originally read “approximately $80,000”)

During discussion prior to the vote, Councilman Thill asked if the extra money could be spent on street repair, and Councilwoman Angela Oglesbee asked whether this would be sufficient funds for the City to operate on.

If the Council had chosen to set a property tax above the Voter Approval Rate, it would have automatically triggered an election for voter approval.

When governmental entities proposed a tax rate for each fiscal year, the “Voter Approval Rate” is normally defined as the rate in which setting a tax rate above this amount would automatically trigger an election for voters to approve the increase.

However, some cities under 30,000 population are not subject to the automatic election requirement, depending on whether their “de minimis rate” exceeds the voter approved tax rate. (Texas Tax Code Chapter 26, Sec. 26.063)

During a Budget Workshop held later that evening, Fairfield EMS and Fairfield Library gave Council members a summary of the past year’s accomplishments along with their budget requests.

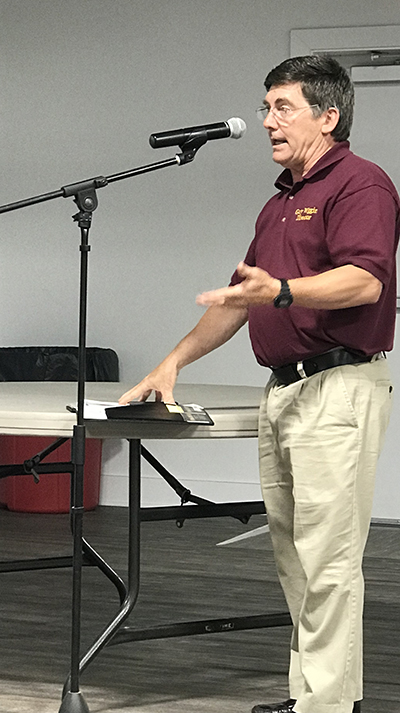

“We had one of the best summer programs this year,” said Fairfield Library Diretor, Gary Wiggins, as he told City Council about the library’s great comeback from the pandemic shutdown.

Also on the agenda were several community organizations requesting Hotel / Motel funding for the coming fiscal year.

Hotel / Motel monies are collected as a special occupancy tax on “any building or buildings in which members of the public obtain sleeping accommodations for consideration” for less than 30 days.

The revenue generated must be set aside for expenditures that directly enhance and promote tourism AND the convention and hotel industry.

Categories approved by the State of Texas to benefit from Hotel / Motel funding include:

–Promotion of the Arts

–Historical restoration or preservation programs

–Certain promotional expenses related to Sporting events

–Enhancement or upgrading of existing Sports facilities

–Transportation for tourists

–Signage directing tourists to sights and attractions

Organizations and event planners presenting to Council members included the annual Fairfield Invitational Basketball Tournament, Freestone County Fair Association, Freestone County Go Texan Scholarship Committee, Freestone County Historical Commission, Freestone County Historical Museum, Moody-Bradley House Foundation, Fairfield History Club, Texas State Coon Hunters Association, and Trinity Star Arts Council.

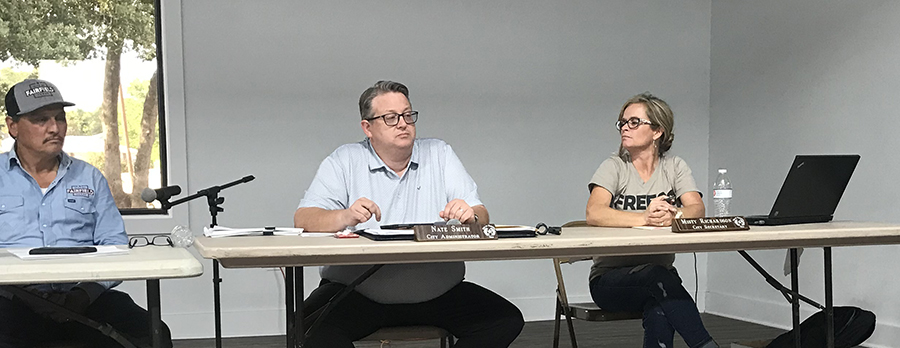

Following the presentations, Fairfield Council reviewed the 2022-2023 Fiscal Year budget with City Administrator Nate Smith, continuing discussions the following evening on Friday, August 5, 2022.

Answering budget questions during the Friday, August 5, 2022 Workshop are Clyde Woods – Public Works Director, Nate Smith – City Administrator, and Misty Richardson – City Secretary.

Discussion and possible action to adopt the budget was on the agenda for a Regularly Called meeting on Tuesday, August 9, 2022.

Click here to read the 2022-2023 proposed budget.

The Property Tax and Budget Hearings will be held at 6:00 p.m. on Tuesday, September 6, 2022 at the Green Barn. This is a special council meeting.

The budget and tax rate will be up for vote at 6:00 p.m. on Tuesday, September 13, 2022 at the Green Barn. This is a regular council meeting.

For more information, visit the City of Fairfield website at www.fairfieldtexas.com

(Photos by Karen Leidy)